Table of Content

You will need to have a good credit score, make enough money, have a reliable payment history, have a low enough DTI and have enough equity in your home to qualify. Taking out a home equity loan or HELOC can be a wise decision if you need money to fund a home improvement project or consolidate high-interest debt. Since the loans are secured by your home, the interest rate is usually lower compared to unsecured loan products such as credit cards or personal loans.

Before applying for a loan, review your monthly expenses and calculate whether you can afford another loan payment. Increasing your credit score and paying off any other debts make you more attractive to lenders. FHA loan guidelines set the lowest minimum credit score requirements of any standard loan program, allowing scores as low as 500 with a 10% down payment.

What Income Is Needed To Buy A House? | Home Loan Experts

A score of 580 is required for borrowers making a minimum down payment of 3.5%. FHA-approved lenders also use the Credit Alert Verification Reporting System, or CAIVRs for short, to confirm you don’t have any delinquent federal debt like student loans. It may be easier to qualify for a mortgage backed by the Federal Housing Administration than a conventional loan.

Loans with an interest only period of less than 5 years are generally accepted under standard lending policy. Keep in mind that some lenders allow LMI to be capitalised above 97% LVR. LVRs may vary by product, loan purpose and security location. Must be based on existing condition of property and/or the on completion value of proposed construction. The valuation of a security is not to include any component for GST cost.

FHA Loan Requirements

These monthly debt obligations are then added to the monthly housing-related expenses. The borrower should write down, before deductions, the total gross amount of income received per month. Home Loan Experts is a business owned by mortgage broking firm Home Loan Experts Pty Ltd.

A borrower of convenience is defined as a borrower that’s added to the loan application to provide serviceability and/or security but doesn’t receive a tangible benefit from the loan transaction. Find out if you can get a VA-backed IRRRL to help reduce your monthly payments or make them more stable. Can I get a top up loan in addition to my existing home loan? Yes, you can get a top up loan in addition to your existing home loan. However, in order to be eligible for the same, you will be required to make regular repayments for your existing loan.

Investment property loan guide: 2022 Guidelines and process

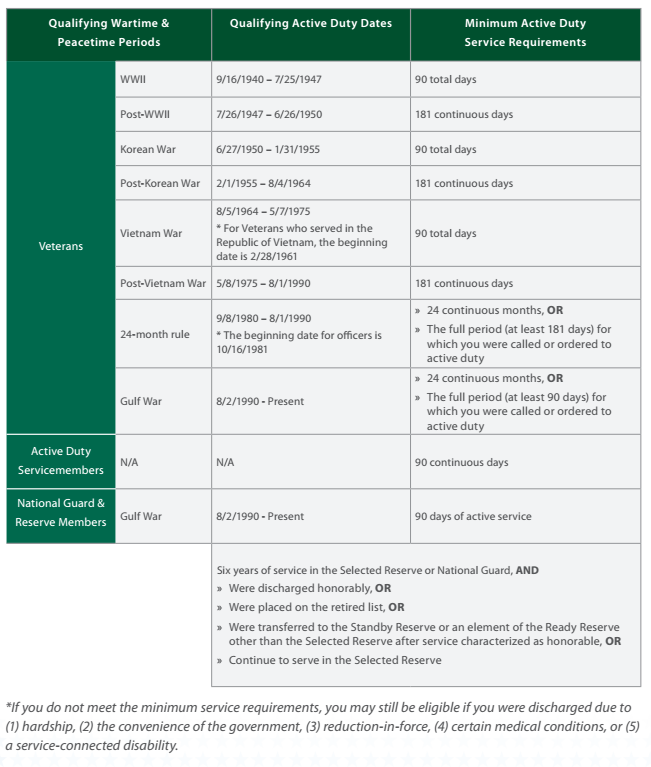

Some lenders will accept a credit card that you can use to “top up” any shortfall in your deposit but you still need to have at least 5% in genuine savings anyway. For family pledge home loans, the guarantor can’t be a pensioner using their owner occupied property as security for the loan. Borrowers must have a beneficial interest in the loan transaction either by way of joint ownership of the security or if the borrowers are in a de facto or marital relationship. This page contains standard lending policy but we have access to specialised lenders that can consider making exceptions. If you’ve served for at least 90 continuous days , you meet the minimum active-duty service requirement. You may be able to get a COE if you didn’t receive a dishonorable discharge and you meet the minimum active-duty service requirement based on when you served.

Select the applicable link below to have a better understanding of our cost structure and costs involved in finalising the process. A competitive quote for applicants aged 64 years or younger from FNB Life, called Mortgage Protection Plan will be supplied. There are certain instances where this will not be a requirement, but this will be specified in your conditions of the loan being granted. Please note that, should you use an insurer other than the one recommended by the bank, you will be required to provide us with an updated policy following the renewal month of the policy on an annual basis.

Factors Affecting The Property Market

As a self-employed borrower, be mindful that too many business deductions on your tax return can reduce your qualifying amount. Lenders use your net income after deductions for qualifying purposes. They can add back some deductions, such as those for mileage and use of a home office. As a rule of thumb, the more business deductions you have, the less you earn on paper. An FHA appraisal costs about the same as an appraisal for a conventional mortgage—in the range of a few hundred dollars. The cost can vary depending on the type of property and where it is located.

Should be a “high net worth” borrower with net assets over $500,000. Valuation should include comparable sales outside the development as well as details of any re-sales within the development. Land size not to exceed 2.2 hectares (5 acres/22,000 m²), although one of our lenders can consider larger land sizes up to 100 ha. Boarding house/hostels can be considered depending on whether the property is classed as commercial or residential. Part of a development that has been converted from another usage.

The eligibility for a joint home loan is dependent on the relationship of the co-applicants. The co-applicants have to be related in order to be eligible for a joint home loan. There are a number of lenders in India who offer home loans for NRIs. You can finance a single-family home, condominium, manufactured home or two-to four-unit home with a VA loan.

You will need certain identification details to do this, such as your medicare number and full name and date of birth. The guarantee of the Family Home Guarantee home loan is for up to a maximum amount of 18% of the value of the property as valued by the participating lender. The small deposit is possible under the scheme as part of the home loan from a participating lender is guaranteed by the National Housing Finance and Investment Corporation . The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

Readvance allows you to withdraw funds from your existing home loan in an easy & convenient manner. A Readvance gives you access to the funds that make up the difference between the original registered home loan amount and the outstanding balance. It's simpler than registering an additional bond and the funds are readily available.

It should be noted that the lender can choose to limit the proposed loan amount for loans that pose a higher risk. Loan amount limits apply on a “per security” basis and vary based on loan product, loan purpose or security location. You’re entitled to borrow 100% LVR when using your parents property as additional security for the loan. The LVR is the loan amount as a percentage of the property valuation.

Tips for qualifying for a mortgage

For FHA loans, the front-end DTI ratio max is 31%, while the back-end DTI ratio is capped at 43%. The front-end ratio only considers your mortgage PITI payment . The back-end ratio looks at your mortgage payment, plus all other revolving monthly debt, including car loans, credit card payments and other loans. You may may be approved for a higher DTI ratio with strong credit scores or extra cash reserves.

No comments:

Post a Comment